Quick Summary

Secure and legally compliant e-signatures are essential for financial services. While there are several options on the market, this guide highlights tools offering advanced security, data protection, and financial-grade compliance. From SignWell’s robust e-signature platform to specialized tools like Docusign and Adobe Sign, these solutions streamline document signing while meeting industry standards.

Looking for an E-Signature Solution to Simplify Financial Processes?

Choosing the right e-signature tool is crucial for financial firms that handle sensitive client data. With many options on the market, financial services companies need platforms that prioritize secure data encryption, legal compliance, and seamless integration with existing systems.

In this SignWell guide, we’ll explore the top e-signature tools designed to meet the demanding requirements of financial services. We’ll cover key features, pricing, and the pros and cons of each option.

But first…

Why Listen to Us

SignWell supports over 61,000 organizations, including numerous financial institutions that rely on secure, compliant e-signature solutions. Our platform is designed with security and regulatory compliance at its core, helping firms manage essential processes, from client onboarding to loan approvals.

With deep experience in the finance sector, we understand the unique challenges financial services firms face when it comes to handling sensitive data, meeting regulatory standards, and optimizing document workflows.

Why Use an E-Signature Tool for Financial Processes?

E-signature tools allow financial professionals and clients to handle documents securely and efficiently. They simplify processes like approvals, document storage, and client onboarding—any tasks that require signatures or document management.

Key benefits in the financial sector include:

- Convenience: Clients and team members can sign documents from anywhere, at any time, eliminating the need for in-person visits.

- Security: E-signature solutions protect sensitive financial data with encryption, audit trails, and compliance with regulations like ESIGN and GDPR.

- Efficiency: By reducing manual paperwork, staff can allocate more time to high-value client interactions and other core financial tasks.

- Cost Savings: E-signatures cut down on printing and mailing expenses, creating budget savings and contributing to sustainability efforts.

Top E-Signature Tools for Financial Services

Below are the platforms we’ll cover:

- SignWell

- Docusign

- WeSignature

- Signeasy

- Adobe Acrobat Sign

- Dropbox Sign

1. SignWell

SignWell offers a secure and compliant e-signature platform designed to meet the needs of financial professionals. With advanced security features, audit trails, and flexible integrations, SignWell provides a reliable and efficient solution for handling sensitive documents. Its user-friendly interface simplifies the signing process, making it accessible for clients and internal teams.

Key Features

- Audit Trail: Provides a detailed log of document activities, including timestamps, IP addresses, and signature actions, ensuring full transparency and security.

- End-to-End Encryption: All data is protected in transit and at rest using AES-256 encryption, the gold standard in data security, ensuring confidential document handling.

- Reliability: Hosted on AWS with high-availability solutions, SignWell’s infrastructure offers fault tolerance, disaster recovery planning, and regular monitoring for reliable service.

- Compliance with ESIGN and UETA: Meets legal requirements for e-signatures, making it suitable for legally binding agreements in the financial sector.

- Document Templates: Enables users to create reusable templates for frequently used documents, saving time and ensuring consistency.

Pricing

SignWell has a free plan that includes 1 sender, 1 template, and 3 documents per month, with basic features like reminders and notifications.

Beyond that, we have 3 paid plans:

Light ($12/month, billed monthly):

- 1 sender (additional senders $12/month each)

- 5 templates

- Unlimited documents

- All basic features plus bulk send and advanced preferences

Business ($36/month, billed monthly):

- 3 senders (additional senders $15/month each)

- Unlimited templates and documents

- All Light features plus custom branding, data validation, in-person signing, and more.

Enterprise (custom):

- Custom sender pricing

- Unlimited templates and documents

- All Business features plus large team plans, high volume API, and dedicated support.

Pros

- Detailed audit trails for enhanced transparency

- Strong data encryption for document security

- User-friendly interface and intuitive workflow

- Offers reusable templates to streamline processes

- Compliant with e-signature laws

Cons

- Limited branding options for lower-tier plans

2. Docusign

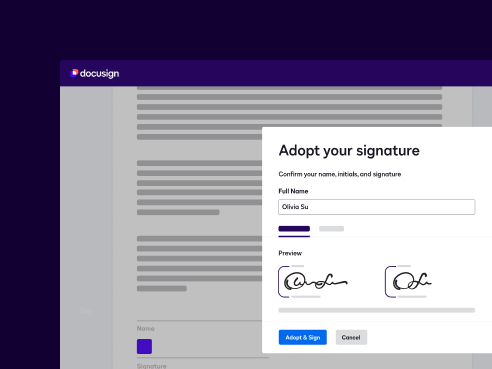

Docusign is a widely trusted e-signature solution designed for secure, compliant digital transactions, making it a great fit for the financial sector. It offers extensive tools for digitizing key processes like account openings, loan approvals, and client onboarding, helping financial firms to streamline and modernize workflows.

Key Features

- KYC/AML Support: Docusign includes identity verification and Know Your Customer (KYC) protocols, ensuring compliance in customer onboarding and other regulated transactions.

- Audit Trail: Tracks each document’s journey, providing a detailed record of signer activity and document modifications for legal compliance.

- AI-Powered Contract Analysis: Uses AI to extract insights and assess risks within agreements, enhancing data-driven decision-making.

- Integrations: Supports over 900 integrations with platforms like Salesforce and Stripe, enabling seamless document management across systems.

Pricing

- A 30-day free trial is available

- Paid plans start at $10/month, billed annually, for up to 5 agreements

Pros

- Strong compliance with financial regulations

- Extensive integration options with CRMs and financial software

- Mobile-friendly for on-the-go signing

- AI tools for contract analysis

Cons

- Higher price point for full feature access

- Some complex features may have a steep learning curve

3. WeSignature

WeSignature is an e-signature tool optimized for financial services, offering features like secure document signing, audit trails, and payment collection. Trusted by businesses for hassle-free e-signature management, it streamlines workflows across industries with a focus on speed, security, and simplicity.

Key Features

- Video Signing Requests: WeSignature’s video feature lets users personalize signing requests with recorded instructions or greetings, adding a personal touch.

- SMS and Email Signing: Allows clients to sign documents directly from text or email, making remote signing convenient and accessible.

- Real-Time Payment Integration: Clients can pay and sign simultaneously through the platform, ideal for transactions like insurance premiums and loan agreements.

- Audit Trails and Document Storage: Tracks every step of the signing process and stores documents securely, providing accountability and transparency.

Pricing

- A 14-day free trial is available.

- Paid plans start at $17.00 / month per user. Includes unlimited e-signature requests and templates.

Pros

- Offers video-based signing requests

- Integrated payment processing for seamless transactions

- Easy mobile access for signing on the go

- Comprehensive audit trails for compliance

Cons

- Limited template options

- Occasional lag in document loading

4. Signeasy

Signeasy provides financial services firms with a secure, compliant e-signature solution, designed to support both remote and in-person signing. It streamlines document workflows, simplifies client onboarding, and supports integration with cloud storage and popular business tools, making it a solid choice for finance professionals.

Key Features

- Audit Trail and Compliance: Generates audit logs for each document and meets ESIGN and SOC 2 standards, ensuring legality and security in financial transactions.

- Multiple Signing Options: Supports in-person signing, mobile signing, and offline signing, making it accessible across different devices and settings.

- Reusable Templates: Speeds up contract processing by letting users save commonly used documents as templates for easy reuse.

- Two-Factor Authentication (2FA): Adds a security layer by verifying user identities through OTPs, protecting sensitive client data.

Pricing

- Free forever plan: can sign and send 3 documents for signature each month

- Paid plans: start at $10/user/month, billed annually

Pros

- Compliant with major e-signature regulations

- Versatile signing options, including offline

- Secure 2FA authentication for client protection

- Cloud integration for streamlined document access

- Reusable templates for document efficiency

Cons

- Limited customization for branding

5. Adobe Acrobat Sign

Adobe Acrobat Sign offers a comprehensive digital signing platform tailored for financial services, emphasizing compliance, security, and seamless document workflows. Integrated with Adobe Document Cloud, Acrobat Sign enables institutions to efficiently manage agreements, onboarding, and applications across digital channels.

Key Features

- Enhanced Regulatory Compliance: Acrobat Sign meets rigorous global e-signature standards, including HIPAA, FERPA, GLBA, and FDA 21 CFR Part 11, along with other industry-specific regulations.

- Advanced Multi-Layer Security: Acrobat Sign incorporates advanced security features such as data encryption, audit trails, and multi-factor identity verification.

- Seamless Salesforce Integration: Integrates seamlessly with Salesforce, enabling financial teams to manage agreements, track workflows, and accelerate approval processes directly within their CRM.

- Automated Document Workflows: Provides intelligent workflow automation, enabling quick document generation, digital tracking, and task reminders.

- Powerful PDF and E-Sign Capabilities: Combines Adobe’s trusted PDF tools with e-signature capabilities, allowing users to create, edit, sign, and share documents effortlessly.

Pricing

- Acrobat Sign comes bundled with an Adobe Acrobat Plan, which starts at $12.99/month, billed annually.

Pros

- Comprehensive regulatory compliance

- Robust integrations with CRM platforms like Salesforce

- Enterprise-level data encryption for secure transactions

- Streamlined document automation for efficiency

Cons

- Managing different types of accounts (personal, educational, business) can be tricky

- Mapping process is complicated when integrating Acrobat Sign with Salesforce

6. Dropbox Sign

Dropbox Sign, formerly known as HelloSign, offers a robust e-signature solution with strong security, compliance, and integration options suited for financial services. Dropbox Sign supports legally binding signatures worldwide and provides features that simplify signing workflows and secure document handling.

Key Features

- Bank-Level Security: Dropbox Sign protects documents with AES 256-bit encryption and SOC 2 Type II compliance, ensuring data security across all transactions.

- Audit Trails: Tracks and timestamps actions throughout the signing process, adding transparency and accountability to financial transactions.

- Conditional Logic: Customizes documents by adding rules that adapt based on signer inputs, creating a faster, more intuitive signing experience.

- Template and Bulk Sending Options: Allows users to send documents in bulk and save frequently used templates, improving workflow efficiency for high-volume transactions.

Pricing

- 30-day free trial available

- Paid plans start at $15/month/user, billed annually. Includes unlimited signing and signature requests

Pros

- High-level security with encryption and SOC compliance

- User-friendly with conditional logic for better workflows

- Templates and bulk send options for efficiency

- Detailed audit trails for transparency

Cons

- Limited advanced customization features for templates

- Limited usage outside the Dropbox ecosystem

Simplify Financial Document Signing With SignWell

Choosing the right e-signature solution is critical for the financial services industry, where security, compliance, and efficiency are paramount.

SignWell is our top option, offering essential features tailored for the financial sector, including document encryption, audit trails, multi-factor authentication, and customizable templates.

With its high level of security and user-friendly design, SignWell ensures smooth, legally compliant e-signature workflows for institutions.

Ready to enhance your financial document workflows? Sign up for SignWell today!

Sign with a team that knows what you need.

Putting a signature on a document shouldn’t be hard. The SignWell mission? Simplify how documents get signed for millions of people and businesses.

Get Started Todaybusinesses served, so far...

total documents signed

customer support satisfaction